Bitcoin remains to be caught in a good vary as market sentiment declines from optimistic to bearish and market members brace for a doable impression. The cryptocurrency was thriving on the potential of a constructive change within the macroeconomic panorama. Did bulls rush right into a entice?

As of this writing, Bitcoin (BTC) trades at $16,800 with sideways motion within the final 24 hours. In the earlier week, the cryptocurrency is holding onto some income, however there’s a probability the bullish trajectory will retrace again to the yearly lows.

BTC’s worth transferring sideways on the every day chart. Source: BTCUSDT Tradingview

Bitcoin Miners Will Contribute With The Downside Price Action?

On the macro scene, the U.S. Federal Reserve (Fed) is the most important hurdle for future Bitcoin income. The monetary establishment is making an attempt to convey inflation down by mountaineering rates of interest. This financial coverage has harmed risk-on property.

Fed Chair Jerome Powell hinted at moderating the financial coverage, however this chance would possibly grow to be much less seemingly. Recent strong U.S. financial knowledge might present help for additional rate of interest hikes.

The market is pricing in one other 75 foundation factors (bps) hike for December. In addition to the Fed’s tightening, the conflict between Russia and Ukraine provides to the market’s uncertainty. The battle is taking a step again in mainstream media headlines, however hostilities are escalating.

#Russia‘s Putin says menace of nuclear conflict is on the rise. Putin says Russia considers nuclear weapons a response to an assault. Says Russia’s nuke weapons are a deterrent think about conflicts. pic.twitter.com/5RMIc7UK6A

— Holger Zschaepitz (@Schuldensuehner) December 7, 2022

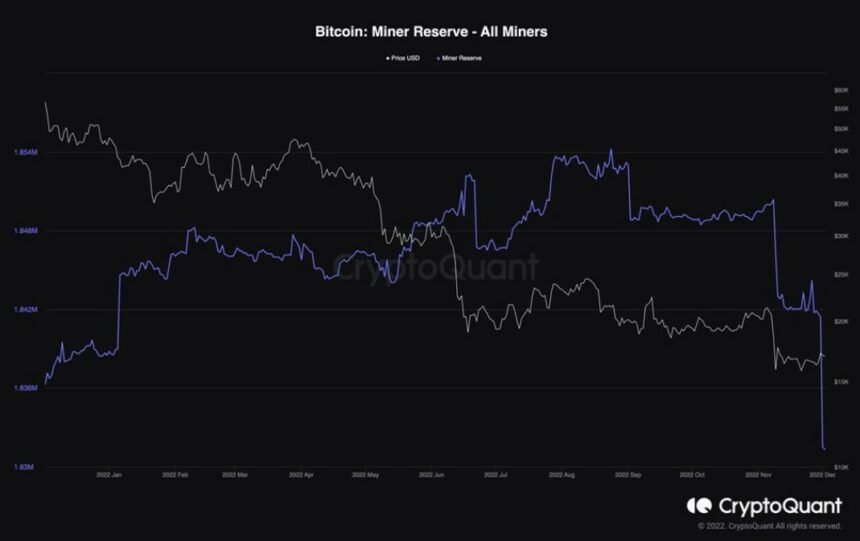

On the native scene, knowledge from CryptoQuant shared with NewsBTC from the most recent Bitfinex report signifies that BTC miners are “transferring a considerable amount of Bitcoin out of their wallets.” These transactions are sometimes bearish indicators for the cryptocurrency.

Miners take out BTC to promote out there and canopy their operations prices. This promoting contributes to BTC’s bearish stress. Bitfinex famous the next whereas sharing the chart beneath:

On the opposite hand, when the worth of the indicator decreases, this means that miners are withdrawing cash from their wallets. Such a pattern may very well be bearish for Bitcoin for the reason that miners may very well be transferring their cash out of their wallets with a purpose to promote them on exchanges. BTC change inflows have additionally elevated barely over the previous week after declining considerably over the few weeks previous to that.

Other Factors To Consider

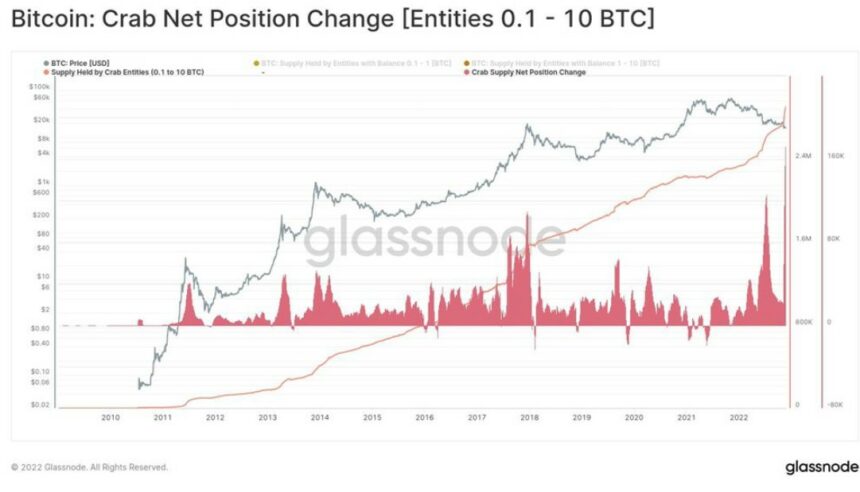

In addition to struggling miners, the market is seeing BTC holders promote their cash at a loss. The Spent-Out Profit Ratio (SOPR) indicator stands above one, which means buyers are capitulating and cashing out as a result of present macro situations.

Bitfinex highlighted elevated retail buyers holding BTC as a constructive takeaway from this knowledge. These buyers are including to their steadiness whereas the value traits to the draw back. These investor courses, the report claims, are “resilient within the face of worth drawdowns” and will lastly put a backside within the BTC worth.