On-chain knowledge reveals the Bitcoin stablecoin provide ratio is now displaying a inexperienced sign that has proved to be worthwhile for the crypto a number of occasions within the final two years.

Bitcoin Stablecoin Supply Ratio Shock Momentum Forms “Buy” Signal

As identified by an analyst in a CryptoQuant submit, out of the 11 earlier such purchase alerts, 10 ended up worthwhile for the crypto.

The “stablecoin provide ratio” (or the SSR in short) is an indicator that measures the ratio between the market cap of Bitcoin and that of all stablecoins.

Generally, every time traders need to keep away from volatility related to cryptos like BTC, they shift their cash into stablecoins. Once they really feel that costs are proper to re-enter the markets once more, they purchase again into them. As such, the full stablecoin provide might be checked out as potential shopping for strain for different cryptos.

When the worth of the SSR is excessive, it means the BTC provide is greater in comparison with the stablecoin cap, and thus there may be low shopping for strain out there at present.

On the opposite hand, low values of the indicator recommend there may be excessive potential dry powder out there proper now. Because of this, such a pattern might be bullish for the value of Bitcoin.

Now, there’s a metric known as the Bitcoin SSR “shock momentum,” which tracks the speed of change in its worth. Here is a chart that reveals the pattern for it over the previous couple of years:

Looks like the worth of the metric has been low in current days | Source: CryptoQuant

As you may see within the above graph, the quant from the submit has marked the related factors of pattern for the Bitcoin SSR shock momentum.

It looks like every time this metric has made a low under the inexperienced dotted stage, the value of the crypto has noticed a purchase sign.

During the final two years, there have been eleven cases of this sample going down, out of which just one has turned out to be a false sign.

Most not too long ago, the indicator has as soon as once more confirmed this formation. If the previous pattern is something to go by, then this will likely become bullish for Bitcoin.

BTC Price

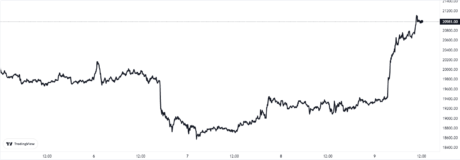

At the time of writing, Bitcoin’s worth floats round $20.9k, up 4% up to now week. Over the final month, the crypto has misplaced 12% in worth.

The under chart reveals the pattern within the BTC worth during the last 5 days.

The worth of the crypto appears to have spiked up over the previous day | Source: BTCUSD on TradingView

Featured picture from Quaritsch Photography on Unsplash.com, charts from TradingView.com, CryptoQuant.com