On-chain information exhibits Bitcoin whales have continued to place promoting strain in the marketplace as the value of the crypto now drops beneath $20k.

Bitcoin Exchange Whale Ratio Has Spiked Up To High Values

As identified by a put up from CryptoQuant, the trade inflows that adopted the US CPI launch result in the value crashing 10% in solely a few hours.

The “trade whale ratio” is an indicator that measures the ratio between the sum of the highest 10 Bitcoin transactions to exchanges, to the overall trade inflows.

Since the ten largest transfers to exchanges are normally from the whales, this metric’s worth tells us how a lot of the overall inflows are coming from these humungous holders.

When the worth of the ratio is excessive, it means whales are making up for a big a part of the overall transactions to exchanges. Such a pattern could be a signal of dumping from this cohort.

Now, here’s a chart that exhibits the pattern within the Bitcoin trade whale ratio (EMA 7) over the 12 months 2022 up to now:

The worth of the metric appears to have been fairly excessive in latest days | Source: CryptoQuant

As you possibly can see within the above graph, the 7-day exponential shifting common of the Bitcoin whale ratio has been elevated lately. This exhibits {that a} large a part of the latest exercise on exchanges has been coming from these holders.

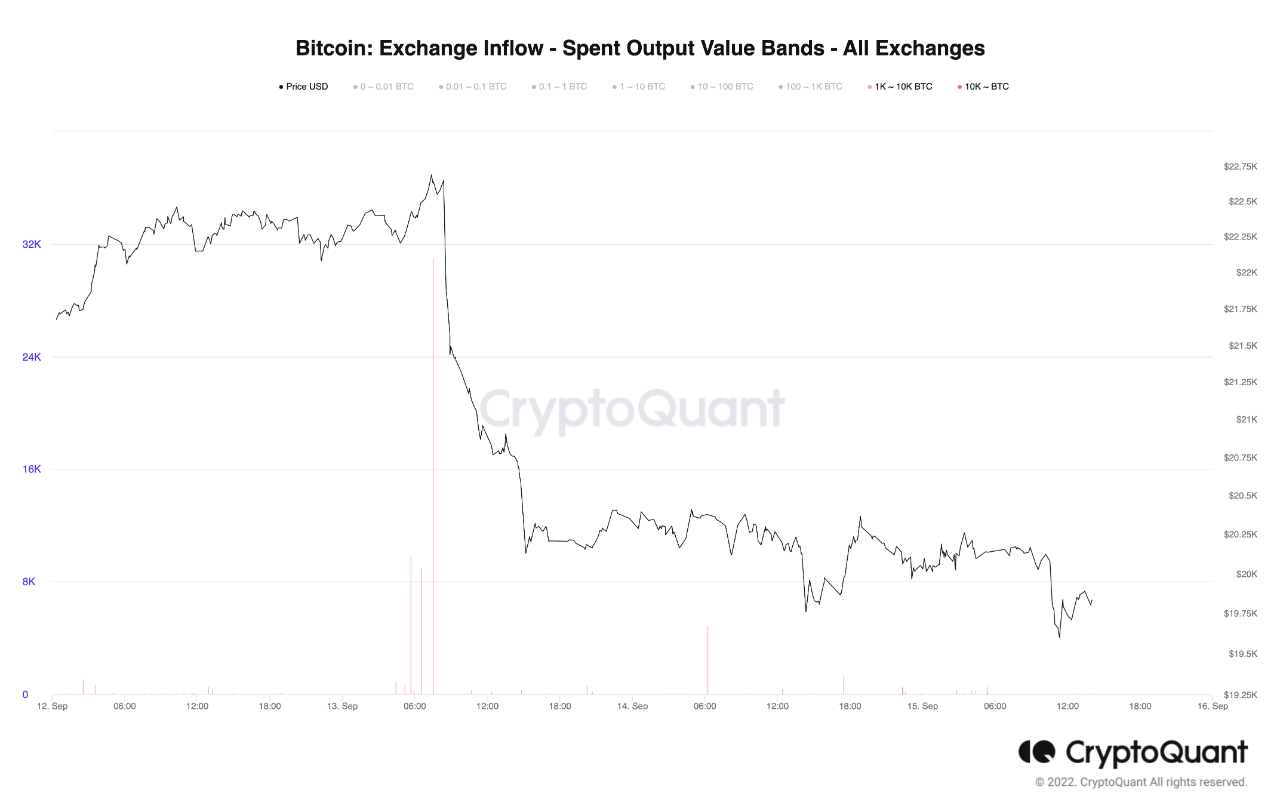

Another indicator, the Spent Output Value Bands, tells us what the person contributions to the inflows are from the completely different holder teams out there. Investors are put into these cohorts based mostly on the quantity of BTC they’re holding of their wallets.

The beneath chart exhibits the pattern on this metric particularly for the 1k to 10k BTC and 10k+ BTC holder teams.

Looks like the 2 cohorts have been lively in latest days | Source: CryptoQuant

As the graph exhibits, each the whales holding between 1k to 10k BTC and people with 10k or extra BTC have actively contributed to the exchanges lately.

Just a few massive spikes from them got here proper earlier than the latest plummet within the Bitcoin worth that took its worth right down to $20k.

The quant within the put up notes that later at the moment’s values of the trade whale ratio might be vital in judging how extreme its shifting common goes to be.

BTC Price

At the time of writing, Bitcoin’s worth floats round $19.7k, down 6% prior to now week.

The worth of the crypto has dipped beneath $20k now | Source: BTCUSD on TradingView

Featured picture from Andrew Bain on Unsplash.com, charts from TradingView.com, CryptoQuant.com