The whole cryptocurrency market capitalization dropped by 5% between Nov. 14 and Nov. 21, reaching a notable $795 billion. However, the general sentiment is way worse, contemplating that this valuation is the bottom seen since December 2020.

Total crypto market cap in USD, 4-hour. Source: TradingView

The worth of Bitcoin (BTC) dipped a mere 2.8% on the week, however buyers have little to rejoice as a result of the present $16,100 stage represents a 66% drop year-to-date. Even if the FTX and Alameda Research collapse has been priced in, investor uncertainty is now centered on the Grayscale funds, together with the $10.5 billion Grayscale Bitcoin Trust.

Genesis Trading, a part of the Digital Currency Group (DCG) conglomerate, halted withdrawals on Nov. 16. In its newest quarterly report, the crypto derivatives and lending buying and selling agency said that it has $2.8 billion value of energetic loans. The fund administrator, Grayscale, is a subsidiary of DCG, and Genesis acted as a liquidity supplier.

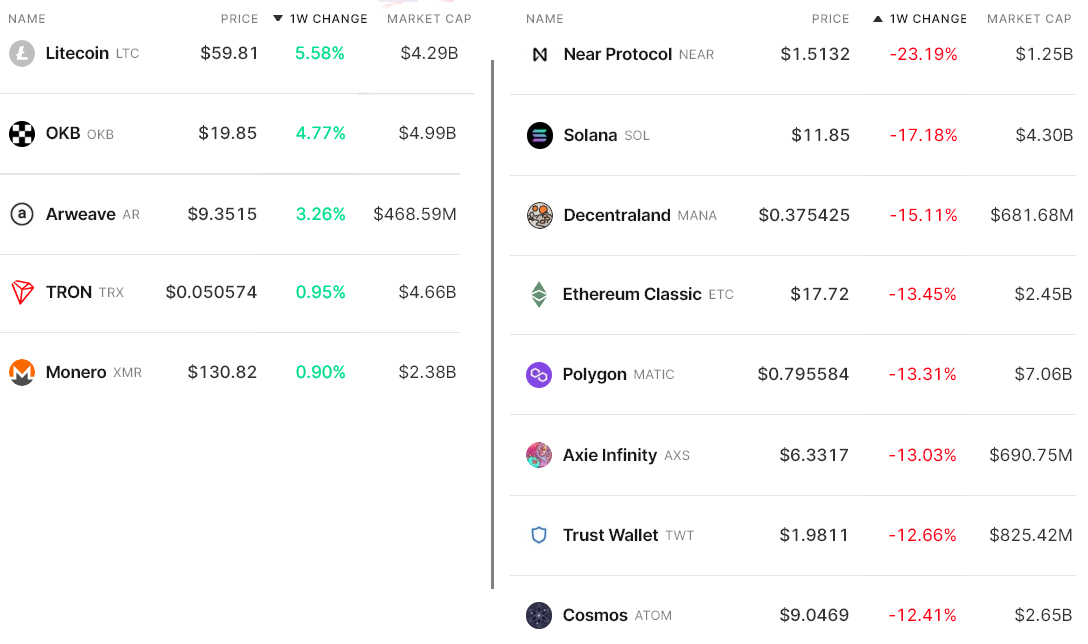

The 5% weekly drop in whole market capitalization was largely impacted by Ether’s (ETH) 8.5% unfavorable worth transfer. Still, the bearish sentiment had a bigger impact on altcoins, with 9 of the highest 80 cash dropping 12% or extra within the interval.

Litecoin (LTC) gained 5.6% after dormant addresses within the community for one 12 months surpassed 60 million cash.

Near Protocol’s NEAR (NEAR) dropped 23% on account of issues in regards to the 17 million tokens held by FTX and Alameda, which backed Near Foundation in March 2022.

Decentraland’s MANA (MANA) misplaced 15% and Ethereum Classic (ETC) one other 13.5% as each initiatives had appreciable investments from Digital Currency Group, controller of the troubled Genesis Trading.

Balanced leverage demand between bulls and bears

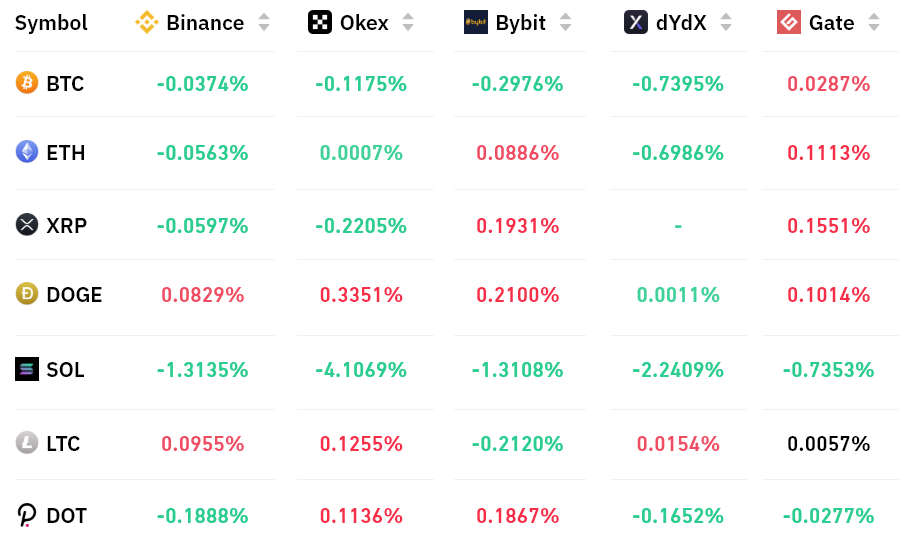

Perpetual contracts, often known as inverse swaps, have an embedded price normally charged each eight hours. Exchanges use this charge to keep away from alternate threat imbalances.

A constructive funding price signifies that longs (patrons) demand extra leverage. However, the other scenario happens when shorts (sellers) require extra leverage, inflicting the funding price to show unfavorable.

The seven-day funding price was barely unfavorable for Bitcoin, so the info factors to extreme demand for shorts (sellers). Still, a 0.20% weekly price to take care of bearish positions just isn’t worrisome. Moreover, the remaining altcoins — aside from Solana’s SOL (SOL) — offered blended numbers, indicating a balanced demand between longs (patrons) and shorts.

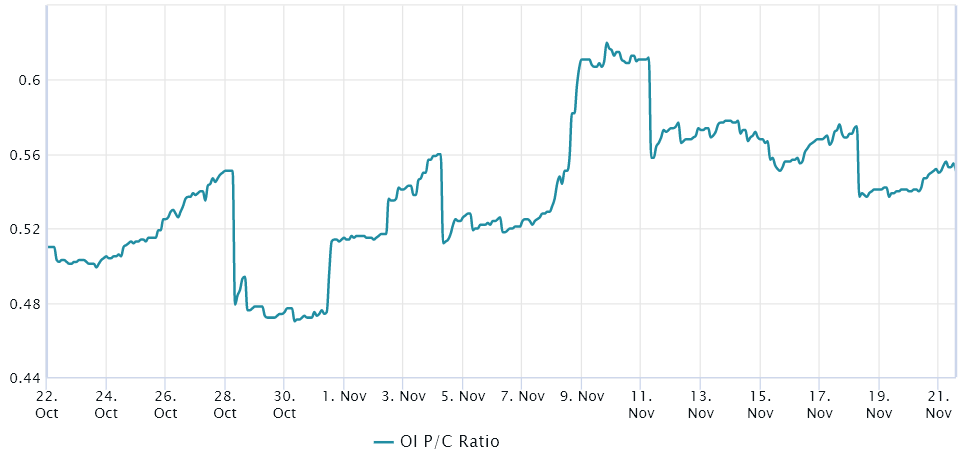

Traders must also analyze the choices markets to know whether or not whales and arbitrage desks have positioned increased bets on bullish or bearish methods.

The choices put/name ratio reveals average bullishness

Traders can gauge the market’s total sentiment by measuring whether or not extra exercise goes by means of name (purchase) choices or put (promote) choices. Generally talking, name choices are used for bullish methods, whereas put choices are for bearish ones.

A 0.70 put-to-call ratio signifies that put choices’ open curiosity lags the extra bullish calls by 30% and is subsequently bullish. In distinction, a 1.20 indicator favors put choices by 20%, which will be deemed bearish.

Even although Bitcoin’s worth broke beneath $16,000 on Nov. 20, buyers didn’t rush for draw back safety utilizing choices. As a end result, the put-to-call ratio remained regular close to 0.54. Furthermore, the Bitcoin choices market stays extra strongly populated by neutral-to-bearish methods, as the present stage favoring purchase choices (calls) signifies.

Derivatives knowledge reveals buyers’ resilience contemplating the absence of extreme demand for bearish bets in response to the futures funding price and the neutral-to-bullish choices open curiosity. Consequently, the chances are favorable for these betting that the $800 billion market capitalization help will show power.

The views, ideas and opinions expressed listed below are the authors’ alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.