Bitcoin worth stays caught under its former all-time excessive set 5 years in the past. The stunning decline has been one of many worst crypto winters on file, and the market is bracing for continued meltdown.

However, a sequence of on-chain indicators in BTC may present clues to how shut we’re to a backside. Let’s have a look.

A Series Of Six On-Chain Indicators Shout: Bitcoin Bottom Is In

Bear markets are brutal in Bitcoin or in any other case, as a result of the underside is simply recognized in hindsight. The feeling that markets will fall without end, creates a worry that freezes traders from shopping for at long-term lows.

Technical evaluation is one instrument that can be utilized to seek out oversold situations or different alerts that help the concept of a backside. Unique to cryptocurrencies, is a subset of quantitative elementary evaluation that focuses on on-chain alerts. Several such instruments are probably suggesting a backside is in.

Here we’ve the Puell Multiple. The Puell Multiple is calculated by dividing the every day issuance worth of bitcoins (in USD) by the 365-day shifting common of every day issuance worth.

Puell Multiple | Source: glassnode

Bitcoin Reserve Risk is at the moment demonstrating probably the most enticing danger/reward setup ever. Reserve Risk is outlined as worth / HODL Bank. It is used to evaluate the arrogance of long-term holders relative to the worth of the native coin at any given time limit.

Bitcoin Reserve Risk | Source: glassnode

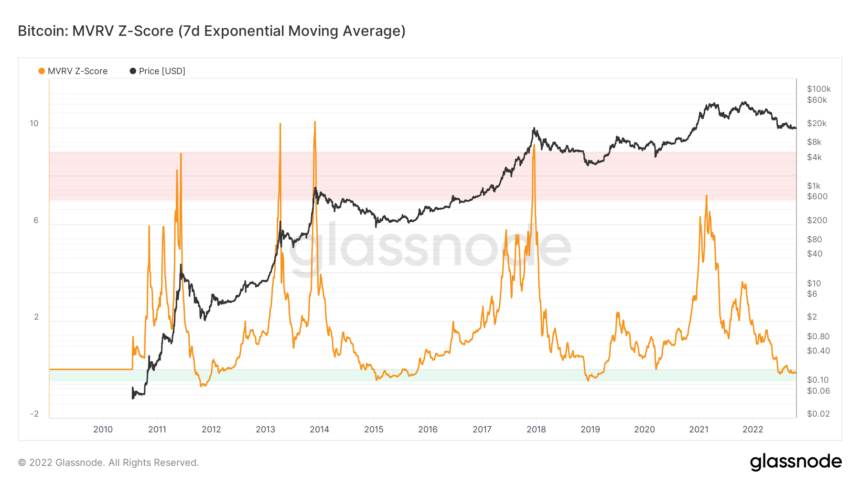

In this chart, we’ve MVRV Z-Score. The MVRV Z-Score is used to evaluate when Bitcoin is over/undervalued relative to its “honest worth”.

MVRV Z-Score | Source: glassnode

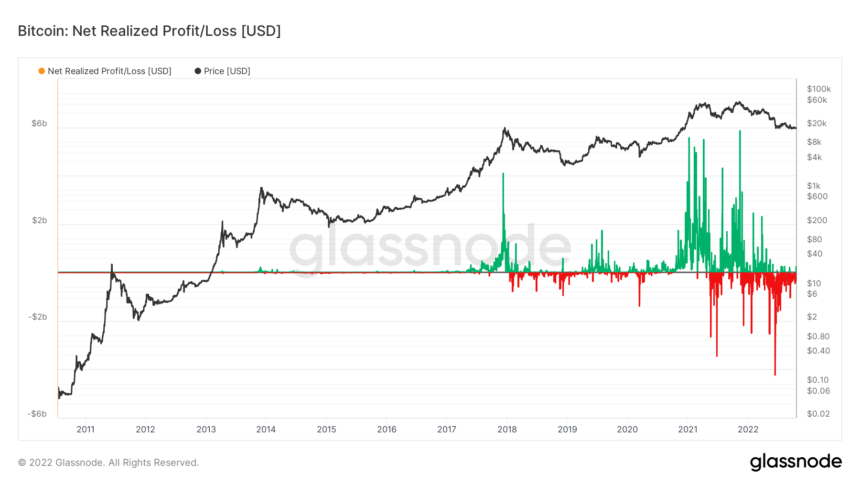

Net Realized Losses are the biggest ever. Net Realized Profit/Loss is the online revenue or lack of all moved cash, and is outlined by the distinction of Realized Profit – Realized Loss.

Net Realized Profit/Loss | Source: glassnode

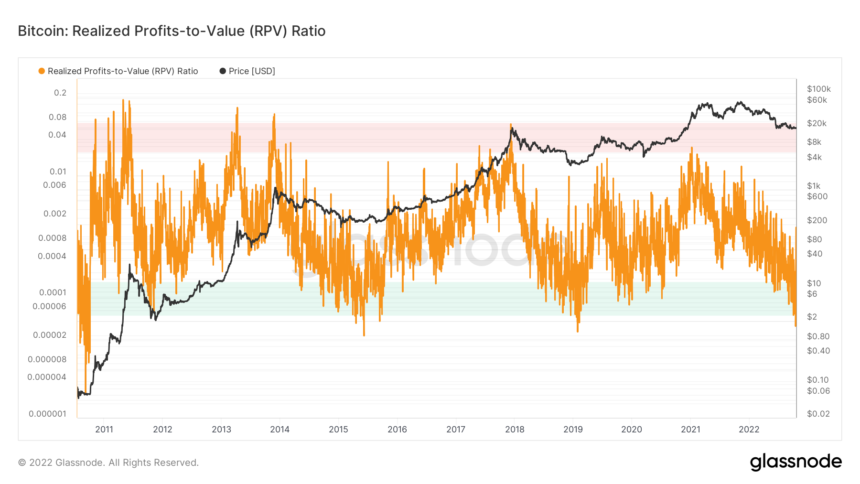

The Realized Profits-to-Value Ratio can also be within the backside zone. The Realized Profits-to-Value Ratio is outlined because the ratio of Realized Profits and Realized Cap. This metric compares profit-taking available in the market with its total price foundation on a dollar-to-dollar foundation.

Realized Profits-to-Value Ratio | Source: glassnode

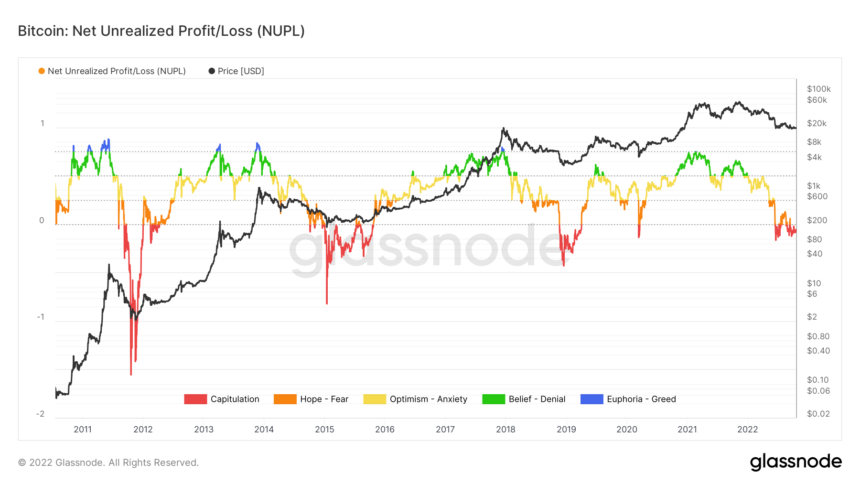

Finally, Net Unrealized Profit/Loss reveals capitulation. Interestingly, BTC by no means fairly reached a state of euphoria and greed over the past market prime. The dataset can also be changing into much less risky over time, very like Bitcoin worth itself. Net Unrealized Profit/Loss is the distinction between Relative Unrealized Profit and Relative Unrealized Loss.

Net Unrealized Profit/Loss | Source: glassnode

While none of those alerts verify the underside is in for Bitcoin worth motion, every instrument is in a zone that traditionally has been the place previous bear markets ended. Should the highest cryptocurrency by market cap backside right here, it will be the smallest most drawdown in Bitcoin historical past.

Follow @TonySpilotroBTC on Twitter or be a part of the TonyTradesBTC Telegram for unique every day market insights and technical evaluation schooling. Please observe: Content is academic and shouldn’t be thought of funding recommendation.

Featured picture from iStockPhoto, Charts from TradingView.com