Ethereum has misplaced bullish momentum over the weekend and hints at a pullback within the brief time period. The cryptocurrency remains to be main the present crypto market restoration with a 14% revenue over the previous week however is likely to be negatively impacted by macroeconomic elements.

Related Reading | Bitcoin Bulls Try To Recoup As BTC Dislodged From $22,000 Level

At the time of writing, Ethereum (ETH) trades at $1,530 with a 5% loss within the final 24 hours.

ETH’s value shifting sideways on the 4-hour chart. Source: ETHUSDT Tradingview

According to a senior analyst at analysis agency Messari, the second cryptocurrency by market capitalization will face a number of challenges this week. As NewsBTC reported, Ethereum was on the coronary heart of the present market aid rally.

ETH core builders set a date for “The Merge”, the occasion that may full its transition to a Proof-of-Stake (PoS) consensus. The extremely anticipated occasion will happen in September this 12 months, however the announcement is likely to be inadequate to mitigate present macro situations.

The Messari analyst believes this week shall be key in shedding gentle on ETH’s value future value motion. Since final week, main companies within the United States have been publishing their earnings studies.

So far, large tech corporations have been displaying comparatively good outcomes. In the subsequent few days, Apple, Meta, Google, Exxon, Ford, Amazon, Intel, and different behemoths will launch their earnings.

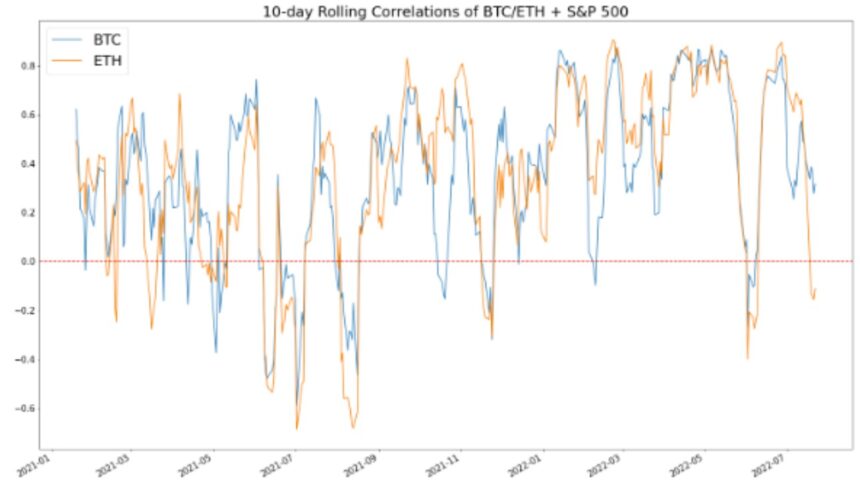

If the outcomes are favorable, Ethereum and the crypto market would possibly proceed rallying past important resistance. The reverse shall be true if these corporations failed to fulfill market expectations. The analyst mentioned the next whereas sharing the picture under displaying ETH and BTC’s correlation with the S&P 500:

Eth correlation with shares is rolling over. If we’ve large misses on earnings, a foul response to the fed and shares rolling out this week shall be THE check is the merge > macro.

As the chart exhibits, ETH’s value has been decoupling from the standard market, particularly the S&P 500 because the begin of July 2022. Most doubtless as a response to “The Merge” announcement, this pattern may reverse on the again of a foul earnings season.

What Lies Ahead For Ethereum

On the opposite hand, if corporations file losses, the S&P 500 and different Indexes may pattern decrease and eventually trace at a possible macro backside for the multi-month bearish pattern throughout world monetary markets.

The analyst famous that solely 21% of the businesses within the S&P 500 have reported their earnings. This leaves a majority of this Index to find out the upcoming pattern in legacy markets and the crypto markets. The analyst added:

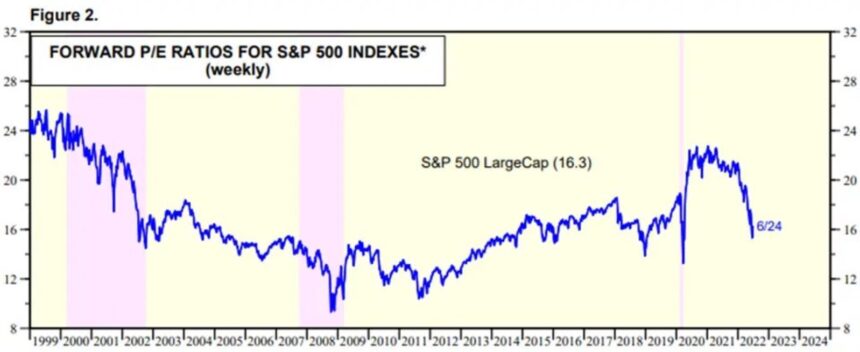

If large tech misses and guides decrease we lastly may see the mark down in shares to mirror the ahead p/e people have been ready for. Earnings est are nonetheless traditionally excessive for any interval, neglect one with a warfare, file excessive infl, a pandemic and so forth.

Related Reading | More Than 57,000 Traders Liquidated As Bitcoin Declines Below $22,000

If Ethereum can undergo the subsequent week unscathed by the turbulence in equities, the bullish momentum may lengthen. $1,700 remains to be a significant resistance level to measure bull conviction, if these buyers can push ETH past this level, the cryptocurrency may very well be set to reclaim a lot increased ranges.