Is the Lightning Network bitcoin’s killer app? It could be, nevertheless it nonetheless has a protracted street forward. One of the stops on that street is the doable inclusion of stablecoins. Does bitcoin want them? Aren’t there inherent counterparty dangers with these? The debate over these questions rages on. And of their newest submit, The Bitcoin Layer makes the case for this improvement to be essential in The Lightning Networks trajectory.

According to The Bitcoin Layer, “a worldwide capital market working on high of bitcoin-denominated monetary rails is inching nearer with every new onramp.” And the Taro protocol and all the belongings it could deliver to The Lightning Network is the mom of all onramps. However, the dangers it brings forth are as massive because the alternatives it presents.

Let’s discover what The Bitcoin Layer has to say earlier than leaping to conclusions. They would possibly shock us.

Making Lightning Interoperable With Everything

The first a part of the article is about Magma, “a Lightning liquidity market that enables nodes to purchase and promote liquidity by leasing different community participant’s channels for a minimal specified time period.” According to the article, Magma’s existence proves “a structural demand for secondary markets of liquidity”. In these markets, “contributors should purchase and promote collateral as wanted—finally blossoming right into a deep and liquid capital market.”

Not solely that, The Bitcoin Layer additionally theorizes about:

“Through time, Lightning Banks will emerge. As market contributors lack the technical wherewithal to effectively function Lightning channels, most Lightning Network channel administration will probably be subsumed by these entities who specialise in it.”

And that is the place the Taro protocol is available in. When it was introduced, our sister web site Bitcoinist posed the next questions:

“So, the primary concept is to create and transact stablecoins over the Lightning Network, however the expertise permits customers to create any asset together with NFTs. And the bitcoin community underpins the entire thing. However, is that this a constructive improvement for bitcoin? How will this profit the Lightning Network? Does a hyperbitcoinized world require tokens?”

And The Bitcoin Layer offers convincing sufficient solutions to these questions. But first…

“Taro makes bitcoin and Lightning interoperable with all the pieces. For the Lightning Network, this implies extra community quantity, extra community liquidity, and extra routing charges for node operators, driving extra innovation and capital into the area. Any improve in demand for transactional capability that can come from these new belongings (suppose stablecoins) will correspond with elevated liquidity on the bitcoin community to facilitate these transactions.”

BTC worth chart for 08/09/2022 on Kraken | Source: BTC/USD on TradingView.com

A Bitcoin-Denominated Global Capital Market

“Using sats because the transmittal rails for transactions throughout each forex opens the door for a bitcoin-denominated world capital market”. No one would contest that. Nor that “the Taro protocol opens the floodgates for this conventional finance liquidity to be subsumed by a sooner, counterparty-free settlement community”. The community is counterparty-free, however, what concerning the belongings’ inherent counterparty threat?

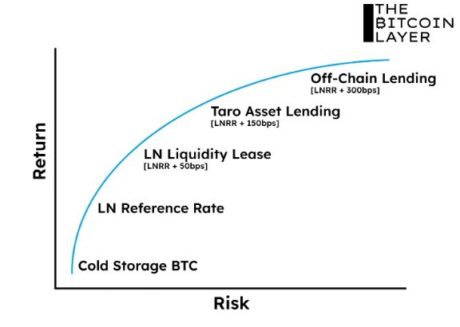

Conceptual Future Bitcoin-Lightning Risk Curve | Source: The Bitcoin Layer

According to The Bitcoin Layer, it’s all about threat and the barrier to entry:

“Higher tiers on the danger curve require much less upkeep however incur extra threat, whereas the decrease ranges on the danger curve incur much less threat however have the next barrier to entry for the typical one that lacks the technical wherewithal for upkeep and safety finest practices.”

And they make the case that the introduction of Taro is an important step within the technique of bitcoin fulfilling its future of turning into the world reserve forex.

“For bitcoin to grow to be a world reserve forex, a deeply liquid capital market is an intrinsic requirement—and the Taro protocol is a promising step in making that occur. While bitcoin and LN are trillions of {dollars} away from turning into a professional different to different capital markets, they arguably preserve the bottom collective threat profile of any capital market in existence, as they’re underwritten by an asset that when custodied incurs zero counterparty threat.”

Zero counterparty threat.

Does The Lightning Network Need Stablecoins, Though?

The reply to that query continues to be up within the air. The Bitcoin Layer acknowledges the inherent counterparty threat these current. It even places them virtually on the high of the danger curve. However, they take into account them essential and even welcome each different asset on this planet to The Lightning Network. According to their principle, that’s how “a bitcoin-denominated capital market” emerges.

Of course, that is all hypothesis. The Taro protocol has not been authorized. Bitcoin’s liquidity is way away from what it must be to grow to be the worldwide reserve forex. And, despite the fact that stablecoins on The Lightning Network could be nearer than we expect, the entire state of affairs takes place in a distant future.

Featured Image by WikimediaImages from Pixabay | Charts by TradingView and The Bitcoin Layer