The value of Litecoin (LTC) might skyrocket by as much as 200% by July 2023, coinciding with its halving occasion, decreasing miner block rewards by 50%.

Litecoin has bottomed out?

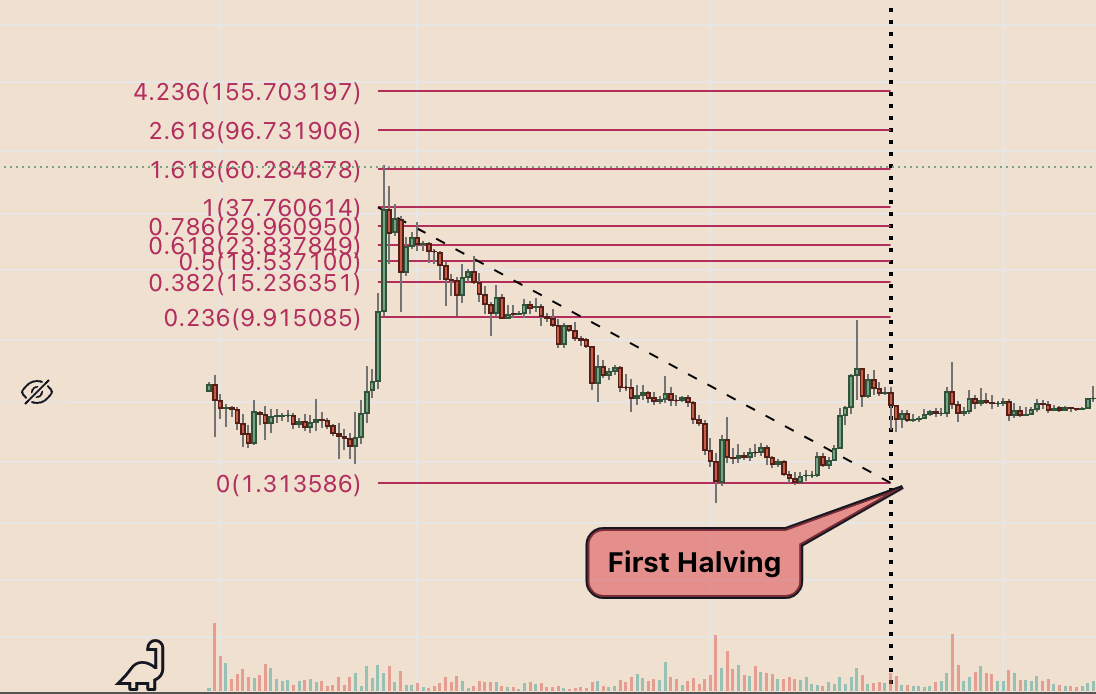

Litecoin has undergone two halvings since its launch in October 2011. The first one occurred in August 2015, which decreased its block reward from 50 LTC to 25 LTC. The second occurred in August 2019, which slashed the 25 LTC reward to 12.5 LTC.

Interestingly, every Litecoin halving occasion occurred after a risky LTC value cycle, particularly an infinite value pump, adopted by a equally huge correction, a value backside, and restoration to a neighborhood prime.

After the Litecoin halvings, LTC’s value corrected from its native prime, established one other backside and adopted it with one other huge value rally to a brand new document excessive, as proven under,

LTC/USD weekly value chart that includes halving fractals. Source: TheScalpingPro

Litecoin’s third halving is scheduled to happen someday in July 2023. Meanwhile, market analysts are already stating that LTC’s value is present process the identical pre-halving trajectory as earlier than the 2011 and 2019 occasions, now within the bottoming-out stage.

The Scalping Pro, an unbiased market analyst, added a dose of MACD and RSI momentum indicators to assist the bullish outlook. Momentum indicators decide an asset’s oversold and overbought situations to foretell potential development reversals.

On a weekly timeframe, LTC’s RSI and MACD have turned extraordinarily oversold, which coincided with market bottoms forward of the earlier halving occasions. Thus, the analyst considers it a robust cue for one more main LTC value rally.

#LTC x RSI + MACD (1W) 2/5

Everytime WEEKLY RSI entered the oversold zone with MACD crossover under the zero line

It has marked #Litecoin backside traditionally.

Past preformance –

2015 ~ +36246%

2019 ~ +1333%

2022 ~ ??? pic.twitter.com/fRbY4VAkuf

— Mags.eth (@thescalpingpro) November 2, 2022

Will LTC value attain $180 by July 2023?

Litecoin might even see a brand new native prime if it has certainly bottomed out close to $40 in June 2022.

Related: Research report outlines why the crypto market is perhaps on the verge of a reversal

Drawing Fibonacci retracement graphs between Litecoin’s pre-halving correction peaks and bottoms highlights the chance of testing the 0.236 and 0.382 Fib traces as their upside targets.

For occasion, in 2011, Litecoin established its native prime on the 0.236 Fib line close to $10 in July, six months after bottoming out close to $1.31.

In 2019, LTC value shaped its native prime on the 0.382 Fib line close to $340 in June after bouncing from round $21 in December 2018.

In the present state of affairs, Litecoin’s 0.236 and 0.382 Fib traces coincide with roughly $130 and $180, respectively.

These ranges might turn into potential native tops if Litecoin confirms $40 as its backside. In different phrases, a 100%-200% value rally by July 2023 when measured from the present value ranges.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Every funding and buying and selling transfer entails threat, it is best to conduct your personal analysis when making a choice.