On-chain knowledge exhibits the Bitcoin trade whale ratio spiked up simply earlier than the crypto’s plunge under the $19k degree.

Bitcoin Exchange Whale Ratio Breached 90% Right Before The Price Dip

As identified by an analyst in a CryptoQuant publish, the whale exercise on exchanges has been raised not too long ago.

The “trade whale ratio” is an indicator that measures the ratio between the highest ten influx transactions to exchanges and the full trade inflows.

The ten greatest transfers are assumed to be from the whales, in order that the metric tells us what a part of the full variety of cash shifting into exchanges is coming from these humungous holders.

When the worth of this indicator is excessive, it means a big a part of the inflows is coming from whales proper now. Such a development is usually a signal of dumping from this cohort and might due to this fact be bearish for the worth.

On the opposite hand, low values of the ratio can counsel whales are making up a wholesome a part of the transactions to exchanges in the meanwhile. This form of development can both be bullish or impartial for the crypto’s worth.

Historically, the metric has normally had values above 0.85 throughout bear markets or pretend bulls, whereas it has usually remained under this threshold throughout bull runs.

Now, here’s a chart that exhibits the development within the Bitcoin trade whale ratio during the last couple of months:

The worth of the metric appears to have been elevated not too long ago | Source: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin trade whale ratio surged up yesterday and hit a price of 0.9, implying that whales contributed 90% of the inflows to exchanges.

This spike within the indicator got here not too lengthy earlier than the plummet within the value of the coin under $19k, suggesting that dumping from whales could have been behind the drop.

The ratio has additionally remained elevated since then, which might imply the cohort is continuous to deposit to exchanges, one thing that would show to bearish for BTC.

BTC Price

At the time of writing, Bitcoin’s value floats round $19.3k, down 4% within the final seven days. Over the previous month, the crypto has misplaced 17% in worth.

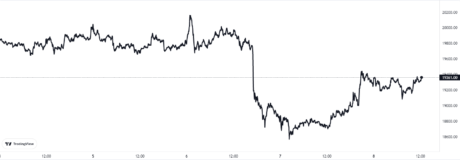

The under chart exhibits the development within the value of the coin during the last 5 days.

Looks like the worth of the crypto has rebounded again a bit of to above $19k once more for the reason that plunge yesterday | Source: BTCUSD on TradingView

Featured picture from Karl-Heinz Müller on Unsplash.com, charts from TradingView.com, CryptoQuant.com