The International Monetary Fund (IMF) printed a examine on the spike in constructive correlation with Bitcoin (BTC), Ethereum (ETH), and Asian equities. The monetary group claims digital property started an accelerated integration with the area throughout the pandemic as extra folks traded them trying to generate yield.

From 2020 to its all-time excessive in 2021, the crypto whole market cap elevated by over 20-fold which led Bitcoin and Ethereum into worth discovery. As seen within the chart under, the whole buying and selling quantity for cryptocurrencies rose very near $900 billion from under $100 billion at its peaked in 2021.

The areas with the very best buying and selling quantity are the Americas and Europe. The Middle East and Central Asia, EM Asia, and AE Asia are under different areas. However, the IMF claims adoption of cryptocurrencies in Asia may pose a scientific threat for the monetary world.

Source: IMF

If the value of Bitcoin and the crypto market reclaim their earlier ranges, and re-entered worth discovery, the monetary establishment believes that there could possibly be unfavourable penalties. If digital property have been to rise and crash as they did over the previous yr, “contagion may unfold by means of particular person or institutional buyers”.

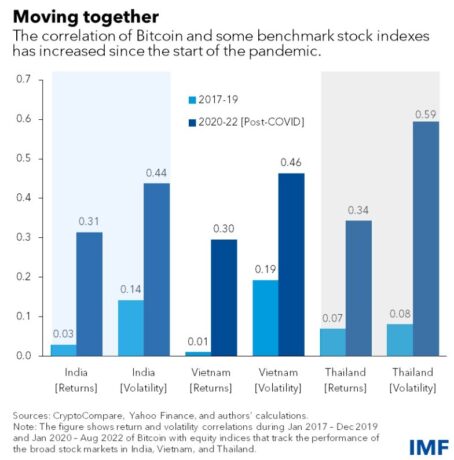

As cryptocurrencies pattern decrease these buyers would allegedly “rebalance their portfolios, probably inflicting monetary market volatility and even default on conventional liabilities”, the IMF mentioned. In that sense, the monetary establishment shared the chart under to indicate the distinction between the value of Bitcoin and Asian inventory indexes.

From 2020 till 2022, this correlation appears to be trending upward with Thailand and Vietnam displaying the very best constructive correlation. This has translated into related worth motion for Bitcoin and conventional equities in these nations.

In India, the correlation between the value of Bitcoin and native equities has elevated by 10-fold with a 3-fold spike in volatility correlations. The monetary establishment believes that if the value of Bitcoin decreases or will increase, there could possibly be “spillovers of threat sentiment”.

Can Bitcoin Lead The Asian Markets Into A Shock?

The monetary establishment means that these “spillovers” are already taking place in Asia. Therefore, authorities within the area have been engaged on implementing a regulatory framework to allegedly mitigate threat.

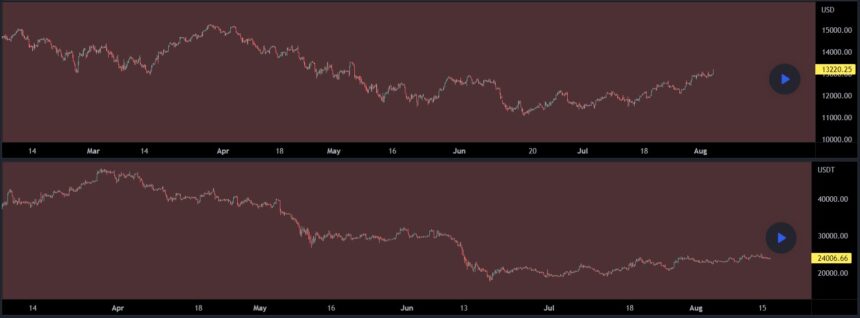

The monetary establishment failed to say that Bitcoin has been displaying a constructive correlation with the efficiency of main equities indexes internationally, the phenomenon shouldn’t be restricted to Asia. As seen under, the value of BTC has been transferring in tandem with the Nasdaq 100 because the begin of 2022.

The constructive correlation has been attributed to present macroeconomic circumstances. These indexes typically move-in tandem with macroeconomic occasions, such because the one the market has skilled since 2020.

Therefore, the constructive correlation between Bitcoin and Asia equities is also attributed to the cryptocurrency reaching excessive adoption ranges quite than a story signal of potential monetary threat.