The Ethereum worth is rallying above essential ranges as “The Merge” is on the horizon, the bullish momentum would possibly obtain a recent push and eventually take ETH north of $2,000. In the meantime, market individuals are speculating in regards to the quick way forward for the second cryptocurrency by market cap.

At the time of writing, Ethereum’s worth trades at $1,710 with a 4% loss within the final 24 hours and a 9% revenue over the past week. After weeks of main the market, ETH is underperforming Bitcoin. The primary cryptocurrency data an 11% enhance in 7 days.

For a deeper dive into the Bitcoin worth and its potential bullish indicators, take a look at our video beneath the place our Editorial Director Tony Spilotro makes the case for the formation of a backside with huge potential for appreciation, just like 2020.

Who Is Most Likely To Sell After “The Merge”?

The market is seemingly divided on “The Merge”, the occasion that can full the ETH transition to a Proof-of-Stake (PoS) consensus. Some anticipate the Ethereum worth will function underneath a “purchase the rumor, promote the information occasion”, different are betting on a bullish continuation.

In a latest report from on-chain analytics agency Nansen, wanting into the highest ETH stakers forward of “The Merge”, the staking dynamics, and its affect to have an effect on the Ethereum worth, there’s a forecast a few potential destructive affect on the cryptocurrency from stakers.

Nansen guidelines out any short-term bearish affect from these traders because the ETH presently locked on the Beacon Chain, the PoS blockchain, might be illiquid for a portion of them till the implementation of the Shanghai improve in 2023. This replace will permit stakers to withdraw their funds.

Illiquid stakers are those who ship their ETH to the Beacon Chain in 2020, they will’t withdraw their funds for an undefined time period, and liquid is these utilizing Lido and comparable options to stake their funds and obtain the rewards.

Of this group, Nansen believes illiquid stakers are much less prone to promote after the Shanghai improve in 2023 if the value stays above $600. There is round 1 million ETH locked at that worth which may “dripped not the market”.

In that sense, the report claims round 71% of all ETH used to safe the PoS blockchain was staked at a loss. Nansen claims 18% of “all staked ETH at current belongs to illiquid stakers which might be in revenue, the class almost certainly to promote as soon as they’re able to unstake”.

However, Nansen isn’t anticipating this promoting negatively impacts the Ethereum worth or to place huge promoting stress on the crypto market. This issue may function as one other bullish elementary for an Ethereum worth submit “Merge”.

ETH’s worth with minor earnings on the 4-hour chart. Source: ETHUSDT Tradingview

Whales Accumulate Ethereum In 2022

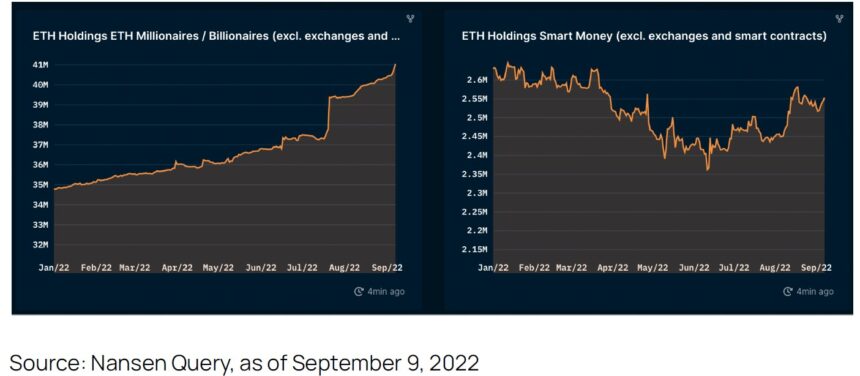

In addition to a potential low long-term destructive affect on the Ethereum worth, Nansen famous a rise within the quantity of ETH millionaires and billionaires. These addresses have been labeled by the on-chain analytics agency as people and never sensible contracts or alternate platforms.

The report claims that these giant gamers have “constantly been stacking Ethereum for the reason that starting of this 12 months”, regardless of the bearish worth motion. As seen within the picture beneath, the pattern has persevered and spiked in August and September this 12 months.

Will tris accumulation positively affect the market or are these whales accumulating to dump ETH shortly after “The Merge”?