In this episode of NewsBTC’s each day technical evaluation movies, we check out the continuing Bitcoin worth breakout above the higher Bollinger Band on each day BTCUSD charts and supply some perception into what the following targets could be.

Take a have a look at the video under:

VIDEO: Bitcoin Price Analysis (BTCUSD): October 26, 2022

The breakout throughout crypto has already resulted in a considerable quantity of shorts liquidated. How far may this Bitcoin rally run?

Bitcoin Rally Approaches Middle Of Trading Range

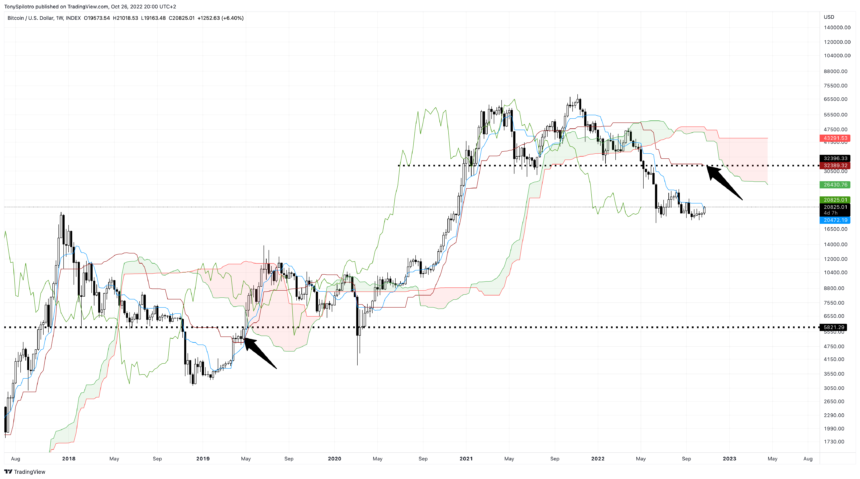

Bitcoin worth is now on the middle-point of a horizontal buying and selling vary, making for a pure stopping level for profit-taking and to attract in a contemporary set of quick positions. Busting via the vary median will lead to one other try at round $25K.

More importantly, the Bitcoin worth is constant to make a robust push outdoors of the Bollinger Bands on each day timeframes. After tightening for thus lengthy, and now beginning to develop, the rally may have extra legs than bears count on.

BTC is trying to interrupt via the median of a the buying and selling vary | Source: BTCUSD on TradingView.com

Related Reading: Can Bitcoin Bring An End To Crypto Winter? | BTCUSD Analysis October 24, 2022

BTCUSD Weekly Hits Resistance At Middle Bollinger Band

That is as a result of Bitcoin worth has already discovered and met resistance on the mid-Bollinger Band on weekly timeframes. The key resistance stage on the 20-week SMA, was the place I positioned a hedge quick entry right now in case the rally is rejected as an alternative.

If there is no such thing as a rejection and Bitcoin retains rising, we could possibly be taking a look at a full-blown return to a crypto bull run. Zooming out reveals simply how important a weekly shut above the center Bollinger Band can be.

Turning on Bollinger Band Width reveals that the bands are a few of the tightest ever. The final two situations have been previous to the 50% breakdown to the 2018 bear market backside. Before that was previous to the epic 2017 Bitcoin bull run that made the cryptocurrency a family identify.

Importantly, in 2018, Bitcoin worth was under the mid-Bollinger Band, whereas in 2016 it was above the mid-BB. The pattern is extra more likely to proceed on no matter aspect of the mid-BB worth is on. If the weekly BTCUSD chart closes above the center band and holds, it could possibly be off to the races as soon as once more for Bitcoin bulls.

Crypto Profit Targets To Watch For Using The Ichimoku

Back to these weekly Bollinger Bands, for a way of what occurs if BTCUSD have been to get via the mid-BB. The higher band would turn into the following logical goal, situated at $23,800. Much like Bitcoin has finished on each day timeframes, pushing outdoors of the higher band is feasible given the abundance of quick curiosity out there.

Replacing the Bollinger Bands with the Ichimoku on the identical weekly timeframe, additionally tells us loads about what may occur subsequent. Bitcoin worth is pushing above the Tenkan-sen, making the following main resistance stage the Kijun-sen situated at $32,000. In 2018, we are able to see that the 2 traces have been a lot nearer collectively, however something is feasible with a lot power constructed up out there.

During the primary bounce from the 2018 bear market backside, Bitcoin worth pushed all the way in which outdoors of the highest of the cloud, solely to make it out of it, however finally lose it as soon as once more on Black Thursday 2020. If Bitcoin worth have been to succeed in the highest of the cloud, the rally could possibly be stopped at $43,000. Once above the cloud, all that’s left for Bitcoin is the moon.