Data reveals the Bitcoin long-term holder provide has surged up not too long ago to close all-time excessive values as these “diamond arms” add to their holdings.

Bitcoin Long-Term Holder Supply Jumps Up By 250k BTC After The Recent Low

According to the newest weekly report from Glassnode, the present complete balances of the long-term holders is barely 30k away from the ATH.

The “long-term holders” (or LTHs in brief) is a Bitcoin holder group that features all these buyers who’ve been holding onto their cash since a minimum of 155 days in the past, with out having offered or moved them.

Generally, the longer holders maintain their BTC nonetheless, the much less seemingly they grow to be to promote them. Because of this, LTHs are the much less seemingly investor group to promote at any level.

The reverse cohort is the “short-term holders” (STHs), who’ve had their cash of their wallets for lower than the 155-day mark.

Now, the “LTH provide” is a measure of the overall variety of cash at present sitting within the wallets of the buyers belonging to this group.

When the STH provide matures sufficient and reaches the edge, these cash are then naturally included within the LTH provide.

Here is a chart that reveals the pattern within the Bitcoin LTH provide over the previous couple of years:

Looks like the worth of the metric has been going up in latest days | Source: Glassnode’s The Week Onchain – Week 36, 2022

As you possibly can see within the above graph, the Bitcoin LTH provide had been on a decline because the ATH and hit a low only a whereas again.

However, throughout the previous few weeks, the indicator’s worth has noticed an uplift. Since the low, LTHs have added round 250k BTC onto their holdings.

The report notes that the 155-day threshold places the minimal acquisition interval for these buyers to be counted as LTHs to be earlier than the LUNA crash.

Due to this, the report thinks it’s doable the availability of those hodlers will stagnate over the subsequent month, and even till mid-October, the place the edge can have then shifted to the post-selloff interval.

BTC Price

At the time of writing, Bitcoin’s value floats round $19.8k, down 1% within the final week. Over the previous month, the crypto has misplaced 14% in worth.

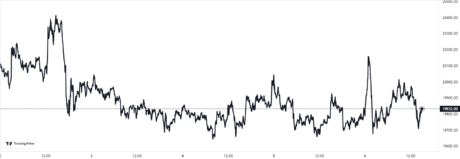

The beneath chart reveals the pattern within the value of the coin during the last 5 days.

The worth of the crypto appears to haven’t moved a lot in the previous few days | Source: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, Glassnode.com