The Bitcoin value is holding on at its present ranges with bullish momentum fading on decrease timeframes. The crypto market’s current sideways value actions appear associated to the upcoming macroeconomic occasions and their potential affect throughout international markets.

At the time of writing, the Bitcoin value trades at $20,500 with sideways motion within the final 24 hours and a 6% revenue over the earlier week. Other cryptocurrencies within the high 10 by market capitalization are displaying energy as BTC strikes sideways, with Dogecoin (DOGE) main, adopted by Ethereum (ETH) and Solana (SOL).

BTC’s value shifting sideways on the every day chart. Source: BTCUSDT Tradingview

The Bitcoin Price In The Short Term, Risk Of Spike In Volatility

The Bitcoin value is below heavy affect from macroeconomic forces. The U.S. Federal Reserve (Fed) is attempting to mitigate inflation by tightening its financial coverage, mountain climbing rates of interest, and lowering international liquidity.

Consequently, Bitcoin and risk-on belongings have trended to the draw back for 2022. In October, BTC confirmed the next correlation with conventional belongings as a consequence of elevated financial uncertainty.

Per a current report by Arcane Research, this established order is more likely to proceed. The analysis agency believes that the Bitcoin value mid-term will nonetheless undergo from a excessive correlation to macroeconomic forces.

Fed Chairman Jerome Powell is dealing with huge strain to pivot its financial coverage from inside and exterior brokers within the United States. If Powell provides in, the Bitcoin value will possible profit and lengthen its bullish momentum.

However, Arcane Research believes it’s extra possible that Powell stays in its present course, making ready markets for additional rate of interest hikes. The monetary establishment and its management wish to decrease inflation within the U.S. greenback whatever the fallout in international markets.

During tomorrow’s Federal Open Market Committee (FOMC) assembly, Powell may supply extra clues. The market expects additional hikes, however any signal of dovishness may set off one other upside transfer.

Bitcoin Market Susceptible To Squeezes

In that sense, Arcane Research data two elements which may contribute to a potential uptrend. The first is excessive leverage throughout the crypto market.

Short positions proceed to pile up because the Bitcoin value traits to the upside. These positions are gasoline for BTC if the market takes the lengthy route.

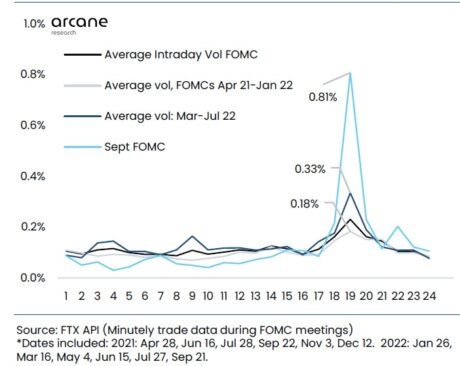

In addition, tomorrow’s FOMC assembly will possible set off volatility which could lead Bitcoin to squeeze out these brief positions and reclaim beforehand misplaced territory. As Arcane Research famous, volatility throughout these occasions is traditionally excessive.

However, the identical is true for the brief facet of this commerce. If the market overreacts to additional tightening, anticipating the Fed to come back out dovish, the cryptocurrency may undergo and revisit the underside of its vary at $18,600. Arcane Research famous:

Prepare for shaky markets in early November, because the occasion calendar is enormously busy within the first half of the month. Tomorrow comes the primary.