Data reveals a considerable amount of shorts have been liquidated within the Bitcoin futures market previously day as BTC pushes above $19,000.

$93 Million Bitcoin Shorts Were Wiped Out In Only 1 Hour

As per information from the on-chain analytics agency Glassnode, quick liquidations have spiked previously day. A “liquidation” takes place when a spinoff change has to forcibly shut up a contract on the Bitcoin futures market.

Contracts normally liquidate when a sure proportion of the margin – the collateral quantity that the holder needed to put up so as to open the place, is misplaced as a result of BTC value transferring reverse to the course the investor bets on.

In the crypto futures market, massive liquidations occurring directly isn’t an unusual sight on account of a few causes. First, many of the belongings within the sector are typically very unstable, so sudden value swings can happen with out warning.

And second, many spinoff exchanges supply leverage (a mortgage quantity taken towards the margin) as excessive as 100x within the unique place. High leverage being accessible in a unstable atmosphere like this leads to a big danger of positions being liquidated.

Now, the related indicator right here is the “whole futures liquidations,” which tracks the full quantity of each quick and lengthy liquidations which are going down within the Bitcoin futures market at the moment.

Here is a chart that reveals the pattern on this metric over the previous few months:

The worth of the metric appears to have been deep purple in latest days | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin futures liquidations have largely concerned quick contracts in the previous few days. This pattern is sensible, as a pointy upwards transfer within the value was the set off for these liquidations.

During the FTX crash again in November, which noticed the other type of value transfer, a lot of longs have been worn out as a substitute, as could be seen from the chart.

Usually, a big sufficient speedy transfer within the value can set off simultaneous mass liquidations that solely feed stated value transfer additional. This amplified value transfer then liquidates much more contracts, and on this approach, liquidations cascade collectively. A mass liquidation occasion like that is popularly referred to as a “squeeze.”

Glassnode notes that $93 million in brief contracts have been flushed in only a single hour in the course of the previous day. These speedy liquidations recommend the Bitcoin rally triggered a brief squeeze within the futures market.

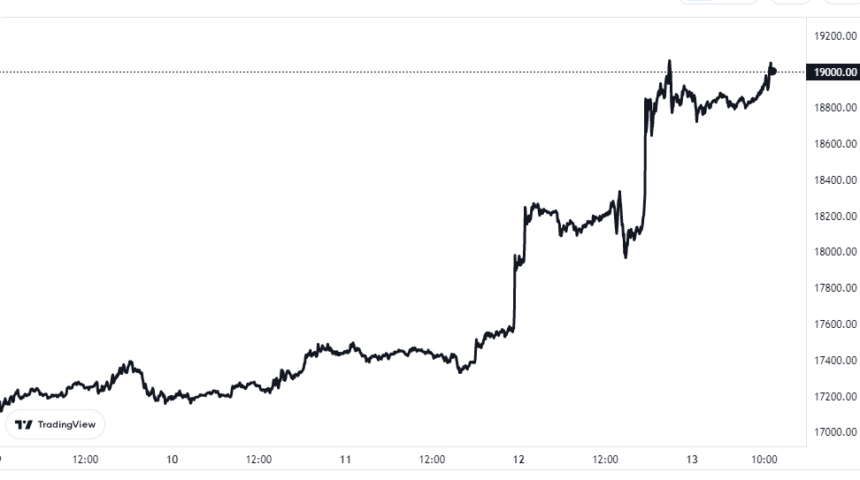

The value has now shot up much more following this squeeze, as is usually the case, and BTC is now above $19,000 for the primary time because the collapse of the crypto change FTX.

BTC Price

At the time of writing, Bitcoin is buying and selling round $19,000, up 13% within the final week.

Looks like BTC has climbed up within the final couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com