On-chain information exhibits the current pattern within the Bitcoin Stablecoin Supply Ratio might recommend the crypto may see a purchase sign quickly.

Bitcoin Stablecoin Supply Ratio RSI 14 Is Near A “Buy” Signal

As defined by an analyst in a CryptoQuant submit, at any time when the SSR RSI has gone beneath a worth of 25 throughout current years, the crypto has noticed a purchase sign.

The “Stablecoin Supply Ratio” (or SSR briefly) is an indicator that measures the ratio between the market cap of Bitcoin, and that that of all stablecoins.

As their title implies, “stablecoins” are fairly steady of their worth as they’re normally tied to fiat currencies. Because of this, buyers within the crypto market shift their cash into them in occasions once they need to escape the risky markets.

This can construct up a reserve within the type of stablecoins that may be readily deployed into cryptos like Bitcoin at any time when buyers really feel the costs are proper to leap again in.

When the worth of the SSR is low, it means the stablecoin market cap is excessive proper now. This suggests there may be a considerable amount of stablecoins piled up presently, which may act as shopping for strain for cryptos like Bitcoin, and therefore might be bearish for his or her costs.

On the opposite hand, the SSR being excessive can suggest the stablecoin market cap is lesser compared to the BTC one in the intervening time. Such a pattern suggests there isn’t a lot dry powder that may help different cash and subsequently may both be impartial or bearish for his or her costs.

Now, here’s a chart that exhibits the pattern within the SSR RSI 14 over the the final couple of years:

The worth of the metric appears to have been taking place lately | Source: CryptoQuant

The “Relative Strength Index” (RSI) data the speed of change in any amount, which on this case is the Bitcoin SSR. In the above graph, the quant has marked the related zones of pattern for this indicator.

It seems to be like at any time when the SSR RSI 14 has attained values above 75, the worth of the crypto has noticed a promote sign. While the metric reaching values decrease than 25 has as a substitute acted as a purchase sign.

Recently, the indicator’s worth has been taking place and is now close to the 25 threshold. However, the purchase sign hasn’t fashioned simply fairly but so it stays to be seen whether or not the metric continues this pattern and breaches the 25 stage or not.

BTC Price

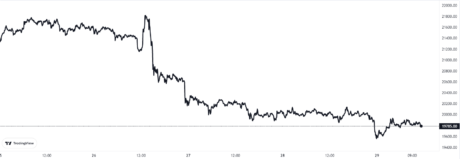

At the time of writing, Bitcoin’s value floats round $19.7k, down 7% up to now week.

Looks just like the crypto’s worth has gone down | Source: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com