One of the acquainted themes seen in earlier crypto market cycles is the shifting market caps, recognition and rating of the highest 10 tasks that see vital beneficial properties throughout bull phases, solely to fade into obscurity throughout the bear markets. For many of those tasks, they comply with a recognizable boom-to-bust cycle and by no means return to their earlier glory.

During the 2017–2018 bull market and preliminary coin providing (ICO) growth, which was pushed by Ethereum network-based tasks, all method of small sensible contract-oriented tasks rallied hundreds of proportion to surprising highs.

During this time, tasks like Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR) and ZCash (ZEC) additionally rotated out and in of the highest 10 rating, however to today, traders nonetheless argue about which mission truly presents a “helpful” use case.

While all of those tokens are nonetheless unicorn-level tasks with billion-dollar valuations, these large-cap megaliths have fallen removed from their earlier glory and now battle to remain related within the present ecosystem.

Let’s check out a number of of the present tasks that threaten to unseat these dinosaur tokens from their perch.

Dollar-pegged stablecoins take the stage as essentially the most “transactable” foreign money

Bitcoin’s (BTC) unique use case stipulated that it will simplify the method of conducting transactions, however the community’s “gradual” transaction time and the price related to sending funds makes it a greater retailer of worth than a medium of alternate when the opposite blockchain networks are thought of as choices.

Terra (LUNA), a protocol centered on creating a world cost construction via the usage of fiat-pegged stablecoins, has emerged as a attainable answer to the problems confronted when making an attempt to make use of the highest proof-of-work (PoW) tasks as cost currencies.

The foremost token used for transacting worth on Terra apart from LUNA is TerraUSD (UST), a U.S. dollar-pegged algorithmic stablecoin that types the idea of Terra’s decentralized finance (DeFi) ecosystem. The market cap of UST has steadily been rising all through 2021 as exercise and the variety of customers within the ecosystem elevated.

UST provide modifications. Source: SmartStake

The current addition of Ether (ETH) as a collateral alternative for minting UST on Anchor protocol has given token holders a approach of accessing the worth of their Ether with out having to promote and create a taxable occasion.

This opens the likelihood for different tokens equivalent to BTC to be utilized as collateral to mint UST that can be utilized in on a regular basis purchases.

As it stands, the borrowing APR for UST on Anchor stands at 25.85%, whereas the distribution APR is at 40.67%, which means customers who borrow UST in opposition to their LUNA or Ether truly earn a yield whereas borrowing in opposition to their tokens.

From privateness cash to privateness protocols

Privacy can also be a cornerstone attribute of the cryptocurrency sector and privacy-focused tasks like XMR and ZEC provide obfuscation applied sciences that help covert or what, for a time, have been considered untraceable transactions.

Unfortunately, regulatory considerations have made it more difficult for customers to entry these tokens, as many exchanges have delisted them for concern of drawing the ire of regulators and the general demand amongst crypto customers has declined alongside their availability.

Their lack of sensible contract capabilities has additionally restricted what these protocols are able to and, thus far, customers don’t look like too enthusiastic about using Wrapped Monero (WXMR) to be used in DeFi, because the token loses its privateness capabilities within the course of.

These limitations have led to the event of privacy-focused protocols such because the Secret Network, which permits customers to create and use decentralized purposes (DApps) in a privacy-preserving atmosphere.

Privacy options are usually not frequent amongst sensible contract succesful platforms within the crypto ecosystem, which makes Secret one thing of an experimental case within the ever-evolving Web 3.0 panorama.

Secret can also be a part of the Cosmos ecosystem which suggests it may well make the most of the Inter-blockchain Communication (IBC) protocol to seamlessly work together with different protocols within the ecosystem.

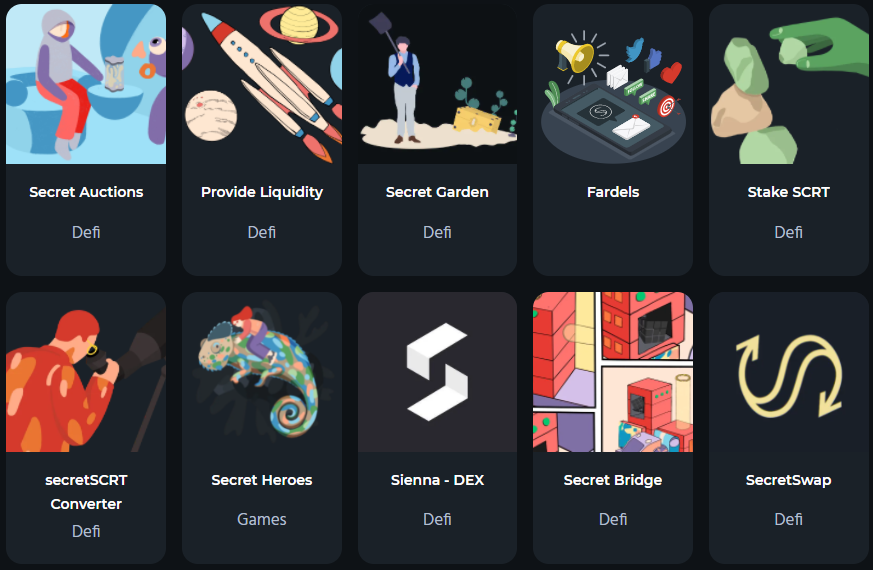

The community’s native SCRT can be utilized as the worth switch medium on the platform in addition to to work together with protocols that function on the community, together with Secret DeFi purposes and the community’s NFT providing, Secret Heroes.

New enterprise options aren’t higher however they arrive with out controversy

One of the methods cryptocurrency tasks sought to distinguish themselves from the “medium of alternate” label was to supply enterprise options as a approach to assist companies navigate the transition to a blockchain-based infrastructure.

XRP and Stellar (XLM) are two of the veteran protocols that match this invoice, however continuous controversy and gradual improvement has resulted in these early movers now taking part in meet up with newer networks that additionally don’t have the authorized controversy that has adopted Ripple for years.

Hedera Hashgraph has emerged as a competitor on this subject and information exhibits that the community is able to processing greater than 10,000 transactions per second (TPS), with a mean transaction charge of $0.0001 and a time to finality of 3-5 seconds.

These statistics are akin to each XRP and XLM, which have indicated that their ledgers attain consensus on all excellent transactions each 3-5 seconds with a mean transaction value of 0.00001 XRP/XLM.

Hedera can also be sensible contract succesful, which means customers can create each fungible and nonfungible tokens, and builders can construct decentralized purposes to accompany the community’s decentralized file storage companies.

For every sector (stablecoins, privateness and enterprise options), the primary distinction between the old-school and next-generation tasks has been the introduction of sensible contract capabilities and plans to develop throughout the side-chain and DeFi sectors the place the highest protocols exist. This provides newer tasks extra utility, permitting them to satisfy the demand of traders and builders, thus rising their token values and market caps in consequence.

With sensible contracts, the power to work together with the rising DeFi panorama comes built-in, whereas the legacy tokens like LTC, XMR and BCH require particular wrapping companies which insert middlemen and thus insert extra charges, rigor and danger into the method.

Newer protocols have additionally embraced the extra eco-friendly proof-of-stake consensus mannequin that aligns with the bigger international shift towards environmental consciousness and sustainability. A plus is that holders may stake their tokens instantly on the community for a yield.

It stays to be seen if the gradual march of time will finally result in a capital migration from older giant cap tasks to the newer era protocols or if these legacy blue-chips will discover a technique to evolve and survive into the long run.

Want extra details about buying and selling and investing in crypto markets?

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Every funding and buying and selling transfer entails danger, you need to conduct your individual analysis when making a choice.