After practically a decade of gridlock, the United States might lastly be on the cusp of crafting a cohesive coverage framework for digital belongings. In Congress, lawmakers are mulling a wide range of proposed payments governing all the things from stablecoins and securities guidelines to sanctions. The 2024 presidential race, in the meantime, will be the first to see crypto as a focus.

While each side of the aisle are enjoying beneficial roles, Republicans — particularly influential congresspeople like Tom Emmer and Patrick McHenry — have emerged because the {industry}’s most essential allies. However, the GOP’s pro-crypto bias can also be its downfall. From uncritical crypto “maximalism” to Orwellian surveillance paranoia, Web3’s {industry} bromides have crept into the get together’s marketing campaign rhetoric and, worse, its coverage proposals. In seminal upcoming legislative alternatives, such because the House’s draft crypto regulatory invoice, Republican policymakers should concentrate on placing “America first.”

Memeified marketing campaign rhetoric

During his presidential marketing campaign announcement in May, Florida Governor Ron DeSantis insisted that “the present regime, clearly, has it out for Bitcoin.” The candidate’s populist purple meat has been the Republican “get together line” on crypto on this election cycle. So far, it has been tough to distinguish the rhetoric of GOP presidential hopefuls from that of “freedom-maximalist” influencers on Crypto Twitter.

For candidates like DeSantis, defending Americans from “a federally managed central financial institution digital foreign money surveillance state” ranks excessive amongst blockchain’s potential use circumstances. Even GOP longshot Vivek Ramaswamy, a biotech entrepreneur who claims to “perceive these things in a way more deep and wealthy approach” than DeSantis, says he views Bitcoin as a “decentralized different” to the U.S. greenback and needs to “make the 2024 election a referendum on fiat foreign money.”

@GOPMajorityWhip Tom Emmer joined me on this essential battle to guard our markets: “American buyers and {industry} deserve clear and constant oversight, not political gamesmanship. The SEC Stabilization Act will make common sense modifications to make sure that the SEC’s priorities…

— Warren Davidson 🇺🇸 (@WarrenDavidson) June 12, 2023

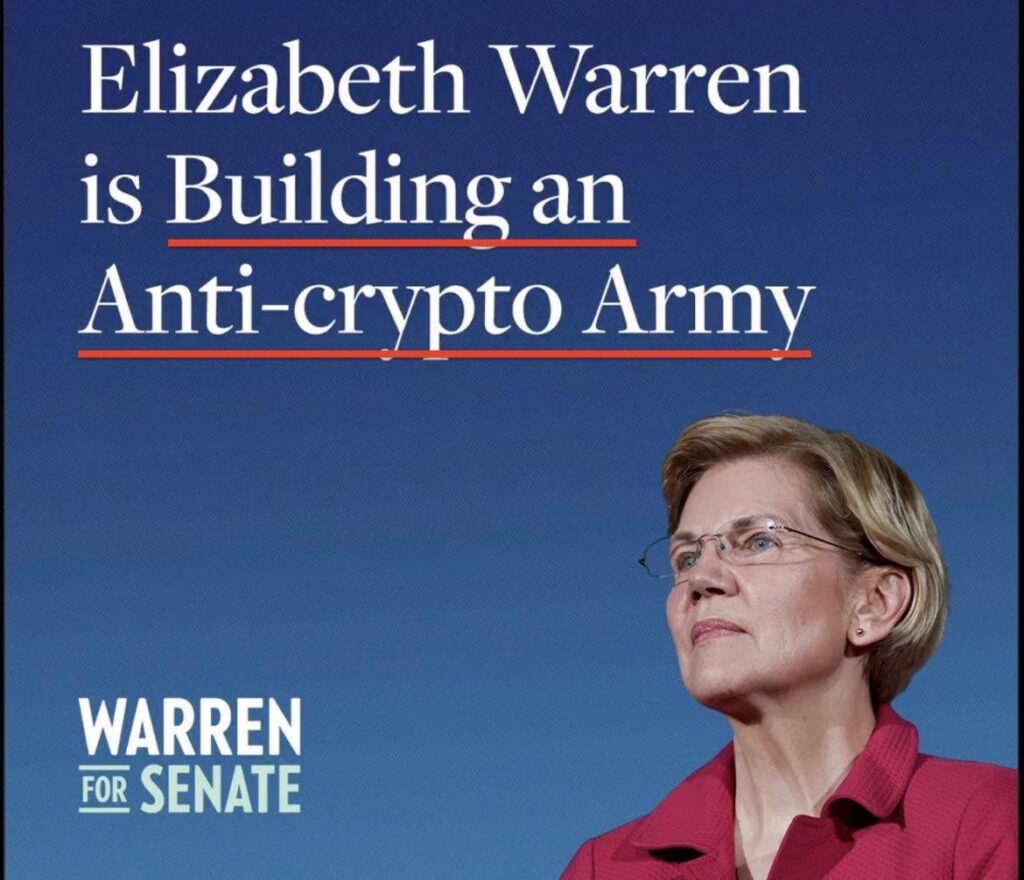

Meanwhile, on the different excessive, progressive Senator Elizabeth Warren and her “anti-crypto military” depict crypto as an omnipresent menace, concurrently eroding investor protections, abetting cash launderers and worsening America’s “tax hole.” What is missing on this partisan hothouse is any knowledgeable appreciation of blockchain’s potential or its significance to America’s long-term financial pursuits.

Misguided policymaking

Among the uncommon exceptions are crypto-savvy GOP lawmakers resembling Financial Services Committee Chair McHenry, who spearheaded the House Subcommittee on Digital Assets earlier this yr. However, the affect of the crypto {industry}’s memeified rhetoric is obvious even within the get together’s innermost policy-making circles.

Take, for instance, the Digital Assets Market Structure (DAMS) invoice. The watershed draft laws, penned partly by McHenry’s committee, marks Congress’s most credible proposed regulatory framework for crypto thus far. While, as Messari CEO Ryan Selkis stated, DAMS is “a 10x enchancment” over previous payments, it nonetheless falls wanting bringing regulatory readability to the {industry}.

Unfortunately, the proposed invoice does extra to manage Web3 as crypto natives think about it to be than because the {industry} operates right this moment. In preserving with Republicans’ long-standing choice, DAMS conceives of crypto belongings primarily as “digital commodities” to be overseen by the Commodities Futures Trading Commission. Indeed, the invoice paves a transparent path for CFTC compliance.

There’s one catch: To qualify as a “digital commodity,” based on DAMS, “every community to which the digital asset relates [must be] licensed to be […] decentralized,” which requires that no single particular person has the “unilateral authority, immediately or not directly, […] to materially alter” the protocol or to “prohibit any particular person [from] deploying software program that makes use of or integrates with the blockchain community.”

Read additionally

Features

This is make — and lose — a fortune with NFTs

Features

Why be part of a blockchain gaming guild? Fun, revenue and create higher video games

In different phrases, a lot of the greater than 160-page draft invoice solely applies, with any certainty, to 2 digital belongings: Bitcoin and Ether. Meanwhile, protocols with any stage of centralized operations (learn: most) stay below the jurisdiction of the Securities and Exchange Commission. Though an enchancment on the established order, the trail to SEC compliance below DAMS is relatively convoluted.

America-first crypto legal guidelines

The GOP might quickly have a shot at defining America’s crypto coverage. Now will not be the time to succumb to partisan speaking factors or {industry} bromides. Lawmakers should clearly assess Web3 because it exists right this moment in order that the U.S. can unlock its advantages for many years to return.

As a primary step, Republicans should bury the half-baked notion that crypto is antagonistic to the normal monetary system. They additionally should overcome their aversion to the SEC. In truth, Web3 and “TradFi” are deeply suitable, and America’s gold-standard safety legal guidelines are a function, not a bug. In the close to time period, policymakers ought to create clear SEC exemptions for digital belongings so nascent U.S. protocols can get off the bottom. Longer-term, officers ought to embrace blockchain’s monumental potential to boost the United States’ regulated monetary sector.

Most importantly, U.S. officers should acknowledge that extending greenback dominance to Web3 is a strategic crucial. Forget about blockchain as an “different” to the greenback; it’s a potent instrument for extending America’s financial attain. Republicans ought to lead the cost.

The House’s newest draft stablecoin invoice is an efficient begin and underscores McHenry’s coverage chops in Web3, however lawmakers can do extra. That consists of supporting Circle Internet Financial, the issuer of USDC. In the Senate, Republicans ought to emulate Roger Marshall by working with crypto-savvy Democrats, together with Warren, to draft industry-friendly KYC and AML guidelines.

Crypto doesn’t have to be “a rip-off in opposition to the greenback.” It is usually a highly effective strategic asset, however provided that U.S. crypto coverage really places America first.

This article is for normal info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed here are the creator’s alone and don’t essentially mirror or characterize the views and opinions of both Umami Labs or Cointelegraph.

Subscribe

The most partaking reads in blockchain. Delivered as soon as a

week.

Alex O’Donnell is the founder and CEO of Umami Labs and labored as an early contributor to Umami Protocol. Prior to Umami Labs, he labored for seven years as a monetary journalist at Reuters, the place he lined M&As and IPOs.