Bitcoin continues to lose momentum on low timeframes, as bulls have been unable to comply with by on yesterday’s upside impulse. The cryptocurrency was rejected across the mid-area of its present ranges and may be certain for a contemporary re-test of native assist.

At the time of writing, Bitcoin worth trades at $20,000 with a 1% loss and a 3% revenue within the final 24 hours and seven days, respectively. Despite its detrimental worth efficiency, BTC stays comparatively robust in comparison with different cryptocurrencies within the prime 10 by market cap.

BTC’s worth transferring sideways on the 4-hour chart. Source: BTCUSDT Tradingview

Bitcoin At Record Correlation With Gold And Equities In 2022

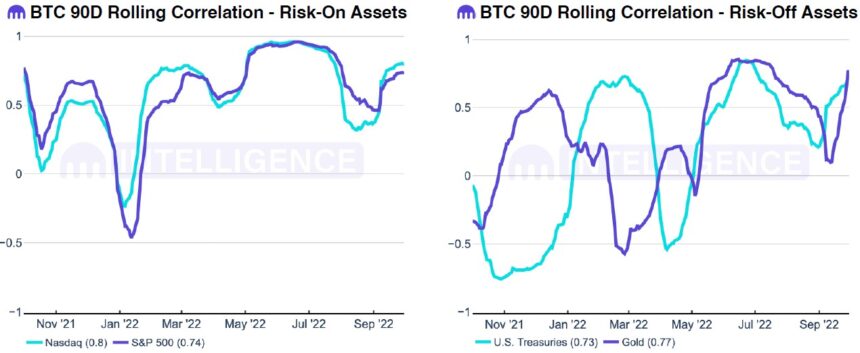

Data from Kraken Intelligence reveals that Bitcoin has been growing its correlation with risk-on belongings, and with different conventional belongings within the legacy monetary market. This phenomenon has been frequent throughout 2022, as international markets transfer in tandem reacting to the U.S. Federal Reserve (Fed).

The monetary establishment has been attempting to decelerate inflation within the U.S. greenback by climbing rates of interest. This has introduced detrimental penalties throughout all belongings class.

As seen within the charts under, the value of Bitcoin noticed a decline in its correlation with main equities indexes, the Nasdaq 100 and S&P 500. In the previous months, this correlation stood at its low under 0.5 however is re-approaching excessive correlation ranges at round 0.8 and 0.74, respectively.

Something comparable is going on with Gold and U.S. Treasuries. Unlike shares, Bitcoin has been much less correlated to the dear steel and U.S. Treasuries, however that seems to be altering in mild of the rise in financial uncertainty.

Earnings Seasons Might Cap Bitcoin Bullish Momentum

This knowledge recommend that Bitcoin may be increasingly vulnerable to occasions associated to inventory and main indices. Jurrien Timmer, Director of Macro for Investment agency Fidelity, believes the upcoming earnings season may carry hurdles for conventional belongings.

Timmer helps his concept on the latest rally within the U.S. Dollar, as measured by the DXY Index. This instrument permits market individuals to get a way of the energy of the greenback in contrast largely to the Japanese Yen, the British pound, and the Euro.

We see the identical disconnect within the chart under, when evaluating the greenback’s price of change to the anticipated EPS progress price (NTM divided by LTM). Estimates must be coming down sooner, it appears. /4 pic.twitter.com/G49jAMu0Y0

— Jurrien Timmer (@TimmerFidelity) October 6, 2022

The greater the DXY Index, the weaker these different currencies, and different risk-on belongings by extension, resembling Bitcoin. Timmer claims that 40% of the S&P income comes from overseas which might result in a noticeable detrimental influence on revenue margins and U.S. firms’ earnings. The professional wrote:

Expectations are for income progress to fall to 4% and keep there. Given that the DXY’s price of change is +19%, that appears too excessive. So, primarily based on the greenback and market breadth, we would get some detrimental earnings surprises.